Weapon Repayment Interpretations

Having a seller account enables an account holder to make the most of merchant cash loan. When a merchant is approved for an advancement, business agrees to obtain a lump sum of cash in exchange for an agreed-upon percentage of future credit card sales. In addition to safety measures, client service agent must offer full reimbursements instantly to any kind of miserable customers.

Can you buy a gun with Apple credit card?

Prohibited Uses

Tobacco, marijuana, or vaping products. Firearms, weapons, or ammunition.

Sometimes, weapons suppliers have actually also had their vendor accounts instantly shut down. When it concerns getting a guns vendor account, it is vital to take the right actions initially in order to keep your service running smoothly. Any person who prepares to offer guns, ammunition, or gun devices should initially get a Federal Firearms Permit. An FFL is a government issued license that allows the marketing and also trading of guns. The FFL should be acquired first in order to legitimately market weapons as well as is necessary to develop a high danger payment cpu for your online or mobile sales.

Various Other Kinds Of Merchants We Process For Include:

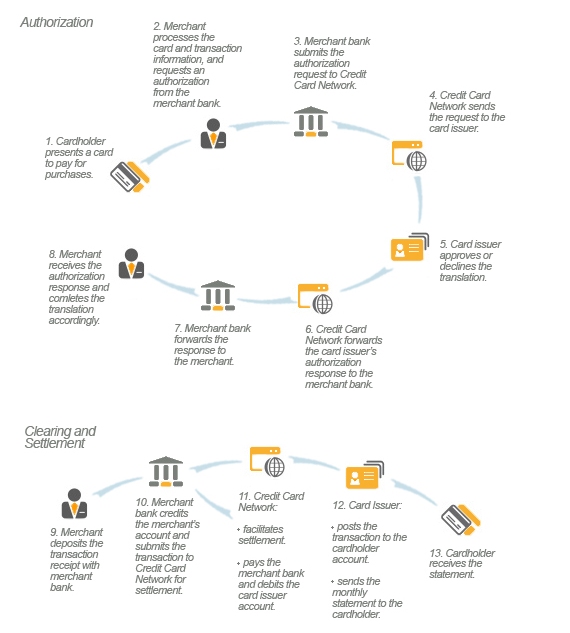

The firm's product or services consist of point-of-sale remedies, mobile phone swipers, Find more info an online payment gateway and digital terminal, EMV-compatible terminals, as well as merchant cash loan. Any kind of company that runs exclusively online is prone to a greater variety of chargebacks. Fraud always occurs regularly in settings where sellers and also customers do not have to deal with a purchase personally. Many times, people utilize swiped bank card to acquire products online and then, market them. Some settlement processing suppliers decline to function with weapon suppliers, while others offer restricted solutions with excessive deal charges. Numerous merchant account carriers refuse to process any online sales of firearms.

Choke Point "Lite" - NRA ILA

Choke Point "Lite".

Posted: Mon, 23 May 2022 07:00:00 GMT [source]

The major factor for this restriction in the authorization of merchant accounts Click here for info depends upon the kind of business being run. The laws that regulate the sale and also possession of firearms are strict, which is another lawful reason that financial institutions as well as repayment cpus aremore inclined to deny solution. There is much less monetary and also online reputation danger to reduce if there are much less laws restricting an industry's sales. Yes, EMB works with vendors that are building their credit, in addition to those who have inadequate credit http://entrepreneurtelegram808.bravesites.com/entries/general/what-is-a-merchant-account-and-also-do-i-require-one- rating. EMB also approves merchants that have no charge card processing background and companies that have lost their seller accounts because of high chargebacks. When dealing solely with on-line transactions, vendors need to do their due diligence to maintain chargeback proportions reduced.

Repayment Portal

When on the internet weapon sales companies make an application for vendor accounts, underwriters take a close aim to guarantee they are running legal, accountable businesses. Throughout their evaluation, experts search for signs to determine whether vendors will certainly create unnecessary financial danger to credit card cpus. The other simple action you can require to lower chargebacks is to have a fair as well as easy-to-find return and also reimbursement policy.

Can I buy ammo with venmo?

PayPal, Venmo, etc.

Payment platforms are also unsafe for both buyers and sellers. All payment platforms strictly prohibit firearm and ammo transactions. That includes PayPal, Venmo, Square, Zelle, and all the others. If they learn you are trying to conduct a firearm or ammo transaction, they will seize your funds.

Utilizing this program indicates that 3 out of every 12 possible chargebacks can be alleviated. Bank card cpus can end the merchant accounts of businesses that can not preserve a 2% chargeback ratios. Once they have been terminated in the past by processors, it is very tough for a vendor to obtain approved another time. These programs are really efficient at helping high danger merchant account owners to take care of and stop fee backs prior to they take place. Online merchants have a tendency to see even more chargebacks than other seller accounts.